How Bureau is Changing Cybersecurity with AI

Bureau's people-first culture is redefining the fraud prevention landscape. Here's how.

India’s digital revolution has opened up services to millions, bringing convenience and new opportunities. But along with these advances has come a wave of cyber fraud, hitting individuals and businesses alike. Cyber fraud has now transformed from isolated scams to a nationwide epidemic of digital crime.

A significant driver of this rapid digitisation is the fact that for many Indians, their first interaction with the internet happened on a smartphone. This “mobile-first” leapfrogging created unprecedented access to digital services but also left many users vulnerable to cyber risks due to a lack of foundational digital literacy and awareness.

For big tech companies, banks, and digital-first businesses, the risks fall into three main categories: financial risk, reputational risk, and regulatory risk. This digital risk landscape has created a pressing need for better fraud prevention solutions. The challenge lies in creating tools that don’t just prevent fraud but also adapt quickly to evolving threats.

Against this backdrop, Startups like Bureau are leading the charge to keep businesses and individuals safe, by leveraging AI-powered identity verification and fraud prevention solutions, (risk mitigation, compliance management) that go beyond traditional, siloed methods. Unlike point-based solutions, Bureau protects customers throughout their entire digital journey—from onboarding to ongoing account monitoring. Tools like Bureau’s have become essential for industries such as banking, fintech, e-commerce, gaming, match-making and the gig economy.

The Bureau Story: Where Technology Meets Trust

Founded in 2020, the global identity decisioning platform for fraud prevention and compliance management is the brainchild of Ranjan Reddy, who earlier founded payments Startup Qubecell in Asia which was later acquired by Boku. At Boku, Ranjan played a pivotal role as Chief Business Officer and spearheaded the creation of an identity division, which was subsequently acquired by Twilio.

Bureau embodies Ranjan Reddy's two decades of expertise in enhancing customer journeys, aiming to create a reliable source for verified identities. Ranjan emphasises here that the platform is designed to process vast amounts of data quickly, allowing businesses to make informed real-time decisions about their customers while ensuring individuals' digital identities and privacy are protected. As a leader, Ranjan understands that fighting fraud at scale requires more than just technology—it demands a blend of advanced data science, understanding market sentiments, and relentless innovation.

Protecting the Future: A Next-Gen Fraud Prevention Platform

Fraud has become a “multi-player game,” as evident by the extreme prevalence of fraud rings and AI-driven scams like the infamous phishing schemes coming out of regions like Jamtara, and Nuh in Haryana, becoming breeding grounds for cybercrime. Traditional verification techniques face several challenges: they often rely on static rules that fail to adapt to new types of fraud, operate in isolation without cross-referencing data across platforms, and struggle with real-time detection. These methods also tend to miss patterns in behavioural anomalies and are limited in their ability to link activities across diverse accounts and devices. As a result, they are often inadequate for identifying complex, organised fraud schemes that cross geographical and digital boundaries. Modern fraud detection goes beyond traditional verification techniques. Tools like identity graphs are becoming essential, which help companies identify fraud patterns across users, accounts, and even across geographical boundaries.

Bureau’s approach combats these challenges head-on. Their Graph Identity Network (GIN), for example, offers a bird’s-eye view of fraud networks, detecting complex schemes across vast transaction chains.

Their technology takes identity verification and fraud prevention to a new level, designed to adapt to new modus operandi as they emerge rather than relying solely on static rules. Here’s how it works:

Protecting the Entire Digital Journey with Adaptive Workflows: Unlike competitors offering isolated solutions, Bureau’s platform lets customers build end-to-end workflows customised to their needs with a simple plug-and-play model*. Need to add a background check or a liveness test? Just two clicks, and it’s seamlessly integrated into the verification flow. This adaptability enables Bureau’s clients to create layered defences that can adjust as fraud patterns shift, offering unmatched flexibility and convenience.

Fraud Detection That Goes Beyond Borders: Bureau’s GIN traces fraud trails across entities, connecting data points to identify fraudsters even when they operate across multiple accounts and identities. This networked approach enables Bureau to unearth complex fraud rings, like money mule networks, that span both time and geography.

Adaptive Fraud Scoring: Unlike traditional fraud prevention solutions that rely on predefined rules, Bureau’s adaptive scoring system evolves with every interaction, re-evaluating risk scores based on changing behaviour within the network. This agility enables Bureau to proactively identify accounts that show a propensity to become 'mules'—accounts that fraudsters may attempt to use as intermediaries for illicit transfers or money laundering. By spotting unusual patterns and inconsistencies in user behaviour and device activity, Bureau can flag high-risk accounts before they are exploited, allowing businesses to take preventive action and protect the integrity of their network.

A Visual Edge in Investigation: With GIN’s clear, visual representation of risk paths, investigators can quickly pinpoint the origin of fraud attempts. This not only makes investigations faster but also uncovers hidden connections that might otherwise go undetected.

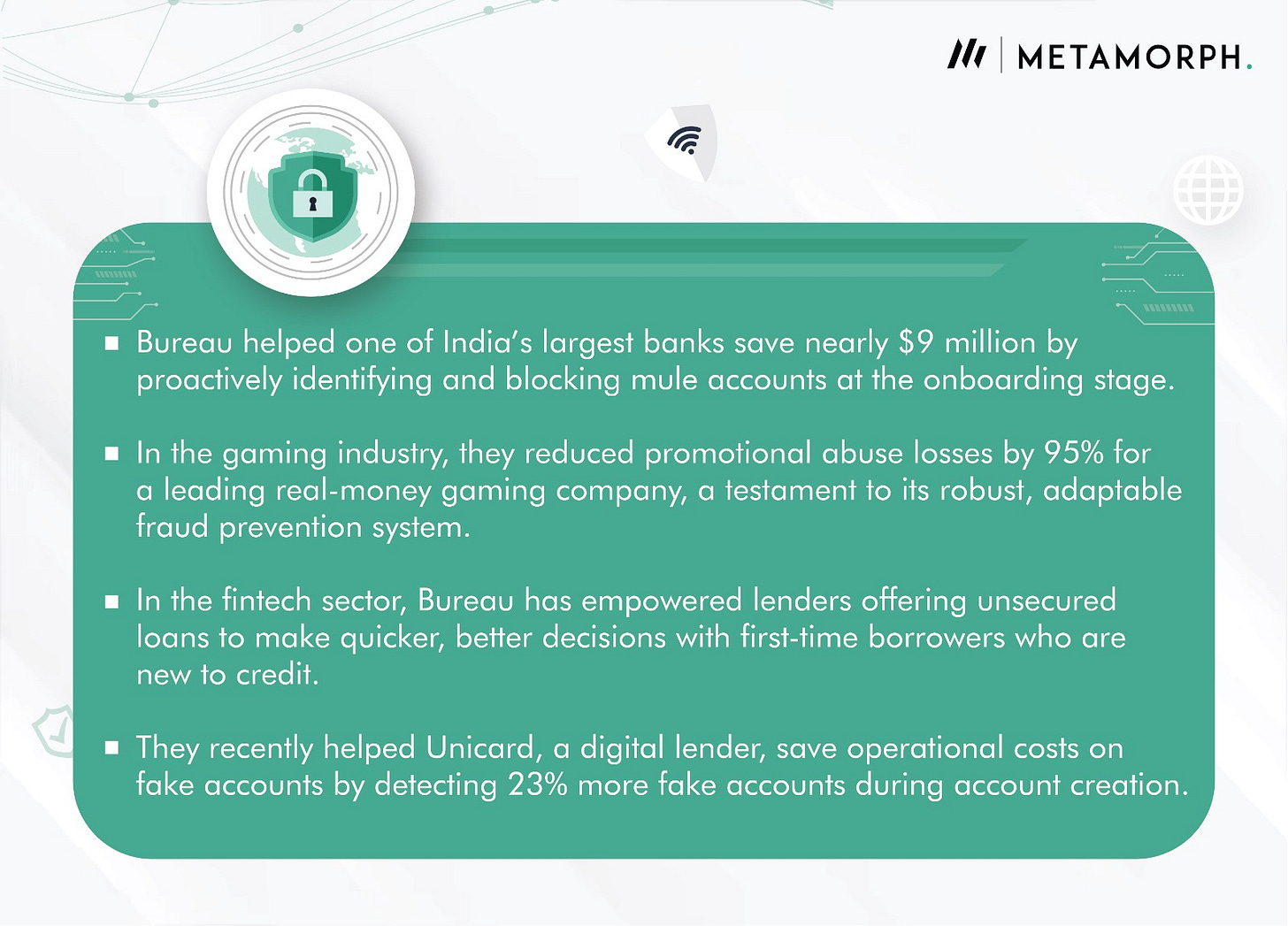

Real-World Impact

For Bureau’s customers—leading banks, fintech firms, e-commerce giants, and ride-hailing services—this means not only reduced financial risks but also protection from reputational and regulatory hazards.

A Culture Rooted in Transparency and Innovation

Bureau’s success isn’t only the result of cutting-edge technology; it’s also driven by a workplace culture that values transparency, trust, and continuous learning. Their workplace culture is designed to harness both technological and human potential. Bureau’s open-door policy and collaborative spirit mean that innovation isn’t limited to a specific team or department; every employee is empowered to contribute ideas and solutions that could shape the company’s future.

In an industry where customer pain points are complex and evolving, Bureau’s approach to continuous learning stands out. Through initiatives like Dev Null sessions and Eureka Express—cross-functional meetups where team members from various pods share insights and best practices—Bureau fosters a sense of shared purpose. This openness doesn’t stop at internal knowledge-sharing; even tech employees are encouraged to join sales calls to gain a first-hand understanding of customer challenges.

One employee shared: “Working at Bureau aligns with my sense of justice and my drive to build a high-trust digital ecosystem. Here, I’ve had the freedom to experiment, take risks, and grow my career by tackling some of the most challenging problems in digital safety.”

To cultivate technical talent from within, Bureau also launched ElevateEng, a program defining clear paths for career progression and professional growth. The program has already proven successful, with all of their tech leads being homegrown talent with three years at the company—a significant achievement for a Startup just four years old. Moreover, the Startup hosts hackathons open to both tech and non-tech employees, encouraging cross-functional teams to innovate together. In fact, several initiatives born from these hackathons have been integrated into their product roadmap, driving impactful changes.

Last year’s hackathon, which welcomed tech and non-tech teams alike, resulted in three standout projects that have become core to Bureau’s roadmap—a testament to their belief in collective problem-solving and innovation.

Bureau’s commitment to growth extends beyond technology. The Startup recently sponsored MetaMorph’s Chhalaang 2.0 - India’s Largest Women-Only Hackathon, which took place in Bengaluru on April 6th. The event was a melting pot of innovation and Bureau’s involvement helped us take the hackathon to another level.

Employee-Centric Policies and Purposeful Perks

Bureau is as dedicated to employee well-being as it is to cutting-edge fraud prevention. Flexible hours, a no-hierarchy structure, and engaging spaces for unwinding—such as their gaming zones—allow employees to recharge and bring fresh perspectives to their work. At Bureau, the tech-focused drive and people-first philosophy aren’t just slogans but tangible benefits that draw talent eager to make a real difference in the digital safety landscape.

As Bureau advances in its mission to secure the digital world, it’s also becoming one of the most inspiring and forward-thinking places to work. Their balanced focus on technology, transparency, and employee growth has made them a destination for top talent in India’s burgeoning tech ecosystem, attracting those passionate about creating a safer, smarter digital future.

Whether it’s helping customers safeguard identities or cultivating a transparent, growth-oriented workplace, Bureau is redefining what it means to be a leader in the fraud prevention space.

Don’t leave us yet!

Looking for more ways to build a thriving startup team? Explore our range of HR services tailored to the unique needs of Indian startups, including talent acquisition, DEI hiring, and employer branding. MetaMorph can help you attract, retain, and empower your most valuable asset – your people.

MetaMorph isn't your typical HR firm. We're a 360° HR Advisory firm dedicated to helping Startups scale, evolve, and grow. We’ve helped more than 220 Startups and multiple hires (and counting), providing them with the platform and opportunities they deserve.